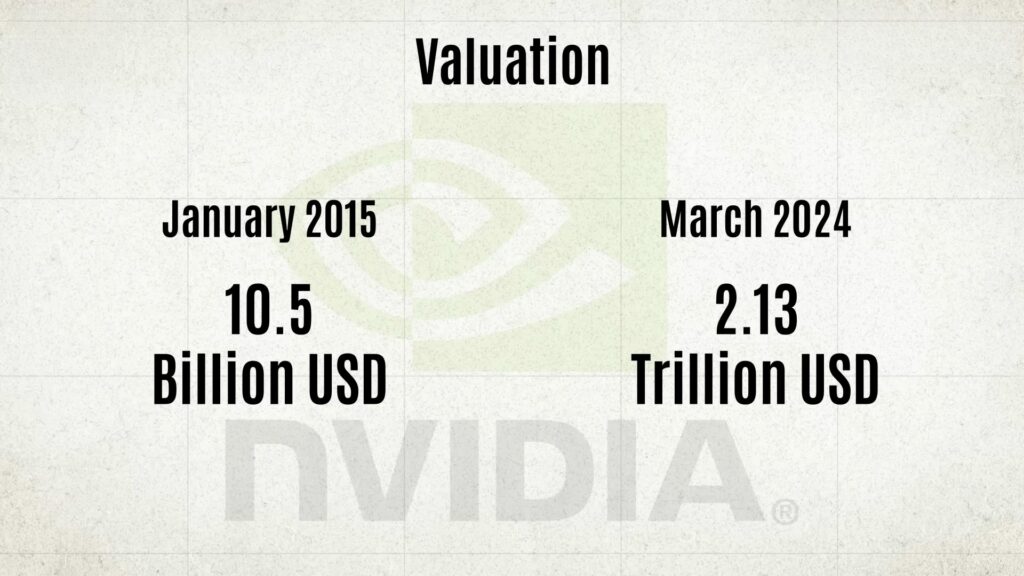

Nvidia is a name familiar to anyone who is knowledgeable about personal computers or gaming. Traditionally known for gaming and graphics-intensive work, this company can essentially be seen as a power-up for other companies. Nvidia’s chips play a crucial role in powering the computational infrastructure of tech giants such as Adobe, Netflix, Meta, Amazon, Google, Microsoft, and even organizations like OpenAI and NASA. As a result, in terms of valuation, Nvidia has become the third-largest company in the world, following Microsoft and Apple. In March 2024, the company’s valuation surpassed $2 trillion. From March 2023 to March 2024, the company’s stock price surged by 350%. Yet, in January 1999, when the company went public through an IPO with a valuation of $625 million, its valuation had only grown to around $18 billion in 16 years by 2015. So, what exactly happened that caused its valuation to surpass $2 trillion in the last nine years? We’ll explore Nvidia’s rise in today’s video.

History

Nvidia was founded by Jensen Huang, Chris Malachowsky, and Curtis Priem. All three were quite successful in their respective careers. Jensen Huang, a Taiwanese-American electrical engineer, had worked as a microprocessor designer at AMD and as the Director of CoreWare at LSI Logic before founding Nvidia. Chris Malachowsky was an engineer working at Sun Microsystems, while Curtis Priem was another engineer who had worked for companies like IBM and Sun Microsystems.

The 1990s were the golden era for personal computers, with new innovations emerging constantly in the industry. During that time, CPUs were sufficient for rendering files on personal computers. However, CPUs were general-purpose processors designed to complete one task at a time. Except for industries like animation or engineering, complex graphics weren’t really needed elsewhere. Video games, on the other hand, require the generation of 3D graphics, which involved completing complex and repetitive tasks. This was not possible with general-purpose CPUs that could only handle one task at a time. Jensen, Chris, and Curtis often debated this issue while sitting in diners in California, eventually coming up with the idea for a chip that wouldn’t replace the CPU but work alongside it, dividing complex and repetitive tasks into smaller chunks that could be processed in parallel. They predicted that the next innovation in personal computers would happen in the graphics-based accelerated computing segment. With this idea in mind, Nvidia was founded on April 5, 1993, in a condo in Fremont, California, with the goal of designing chips capable of parallel processing for PCs. Right from the start, Nvidia aimed to be a fabless semiconductor company, meaning they would only design chips, but the manufacturing would be done by another company. Jensen Huang chose this strategy from the beginning to reduce costs. Interestingly, the name Nvidia was chosen by combining “Next Version” with the Latin word “Invidia” (meaning envy). The three friends believed that Nvidia’s chips would be the next generation of computational power, and the processing capabilities of these chips would make others envious. That’s why Nvidia has always used the color green—symbolizing envy—in their logo and packaging.

The company was up and running, but it needed funding to operate. Jensen Huang used his personal connections to set up a meeting with Sequoia Capital through the help of the CEO of his former workplace, LSI Logic. At that time, about a hundred other companies were working on the same idea. However, Nvidia managed to raise a total of $20 million from Sequoia Capital, first securing $2 million, followed by an additional $18 million. For product development, Nvidia chose the gaming industry, as it was the only industry at the time that needed both graphics-intensive computational power and a rapidly growing market. In other words, this market had both the necessity and the demand for such a product, which was continuously increasing. Nvidia built a small team, and after two years of research and R&D, spending $10 million, they released the NV1 chip in December 1995. However, due to using a technology different from the market standard, not supporting existing standards, and being more expensive compared to contemporary chips, the NV1 chip didn’t perform well in the market. The chip turned out to be a $10 million disaster for Nvidia. The company had to lay off nearly half its employees to survive. Nvidia also had to abandon plans to develop the NV2 chip for the game developer Sega.

The Rise

Instead of the NV2, Nvidia launched the RIVA 128 Graphics Processing Unit (GPU) in 1997, though the company had not yet started using the term “GPU.” This new product was designed to target Nvidia’s PC market, supporting industry leader Microsoft’s DirectX, Direct3D, OpenGL, and other standards, which helped it gain significant market traction. Within just four months, the company sold over one million units of the RIVA 128. Before the launch of RIVA 128, the company had just enough funds to pay its employees for one month. Jensen Huang had started a staff presentation with the words, “Our company is thirty days from going out of business,” which for a long time became the company’s unofficial motto. Over the next two years, two more versions of the RIVA 128 were launched, both of which performed well in the market. Building on this success, in January 1999, Nvidia went public through an IPO and got listed on the NASDAQ Stock Exchange, valuing the company at $625 million. In October of 1999, Nvidia released the GeForce 256, the world’s first GPU. In fact, it was the GeForce that introduced the term GPU globally. The GeForce 256 was a game-changing product in graphics processing, making a significant impact in the market.

The success of the GeForce 256 elevated Nvidia’s reputation, and in 2000, the company won a contract to develop the graphics hardware for Microsoft’s Xbox gaming console, securing a $200 million advance from Microsoft. That same year, Nvidia released the GeForce 2, which also performed well in the market, and the company’s revenue nearly doubled, reaching $735 million. In that year, Nvidia acquired the intellectual assets of its one-time rival, 3dfx. By 2001, although the graphics processor market was growing, only 12 companies remained in the industry. Companies like S3 Inc., NeoMagic Corporation, and Intel stopped developing products for the graphics market, and many others began merging. By 2001, Nvidia continued releasing new GeForce graphics cards, and its revenue once again doubled to $1.4 billion. By the end of that year, Nvidia replaced Enron on the S&P 500 Index and was recognized by the Fabless Semiconductor Association as “The Most Respected Public Fabless Semiconductor Company.”

In the following years, Nvidia began acquiring rival companies and those developing programming platforms for GPUs. Major industry players began adopting Nvidia’s graphics cards. In 2004, Nvidia was tasked with developing the graphics hardware for Sony’s PlayStation 3. Additionally, companies like Apple, Dell, and HP began using Nvidia’s GPUs in their devices.

In 2006, Nvidia released CUDA. Realizing the potential of the GPU’s parallel processing power, Nvidia had been working for several years on developing a tool to help developers use GPU power for tasks beyond gaming and animation. This effort resulted in CUDA, a software toolkit that allowed developers to use programming languages like C, C++, and Java to easily develop GPU-based programs. The impact was massive. Besides graphics-based software, industries that require large amounts of data processing—like data centers, autonomous driving, cloud computing, machine learning, deep learning, and video streaming—began increasing their use of GPUs. Companies like Amazon AWS, Google Cloud, and Netflix adopted GPUs for various processes. However, CUDA’s most significant impact was in AI development. The parallel processing power of GPUs made running large language models much easier. Additionally, Nvidia’s CUDA influenced technologies such as cryptocurrency mining and blockchain. It can be said that the rise in AI development from 2012 to 2024 began with Nvidia. During this time, Nvidia consistently developed and released GPUs for PCs, gaming consoles, and data centers.

Since 2000, Nvidia and AMD have been in competitive positions regarding graphics card market share. However, after 2006, Nvidia consistently shipped more GPUs each quarter than AMD, becoming the clear market leader.

Around 2009, Nvidia released a system-on-chip (SoC) called Tegra for mobile devices. Initially, this chip was used by Microsoft’s iPod competitor, Zune HD, and several Android tablets. However, the ARM-based Tegra couldn’t compete with Qualcomm Snapdragon. In response, Jensen Huang decided to collaborate between the mobile and autonomous driving divisions. Nvidia shifted its focus from smartphones to the automotive sector for the Tegra SoC. As a result, in 2012, the Tegra 3 SoC began to be used in Tesla Model S electric vehicles and Audi vehicles in 2013. In 2016, Tegra hardware was also used in the Nintendo Switch gaming console.

By 2016, with the rising demand for GPU mining in cryptocurrency, Nvidia’s market share surpassed 70%. Continuing the development of GeForce and Tegra graphics hardware, Nvidia released the Nvidia GeForce RTX graphics card in 2018, based on the Turing Architecture and equipped with ray-tracing capabilities. The RTX graphics card was the industry’s first real-time ray-tracing capable graphics card.

Since 2006, Nvidia has consistently held over 60% of the global GPU market share. In 2015, Nvidia overtook AMD, grabbing an 80% market share for the first time. Based on increasing demand for gaming, cloud computing, data centers, crypto miners, and AI research, Nvidia has maintained a market share of 70% to 80% since 2018. In fact, according to Statista, Nvidia held an 82% market share based on global shipments in the third quarter of 2023. One of the key driving factors behind this growth since 2018 has been the rise of AI research. In 2016, Nvidia gifted its first DGX-1 supercomputer, which was developed for AI research, to OpenAI. This supercomputer reduced OpenAI’s complex AI model training time from six days to two hours. Since then, Nvidia has been the brain behind GPT. Even though OpenAI uses Microsoft’s Azure cloud infrastructure, Nvidia’s graphics chips are used there as well. After OpenAI’s success, Nvidia has provided custom chip design support for companies around the world, from Google, Meta, Amazon, and Apple to others conducting AI R&D. This has been one of the key factors in Nvidia’s market share growth.

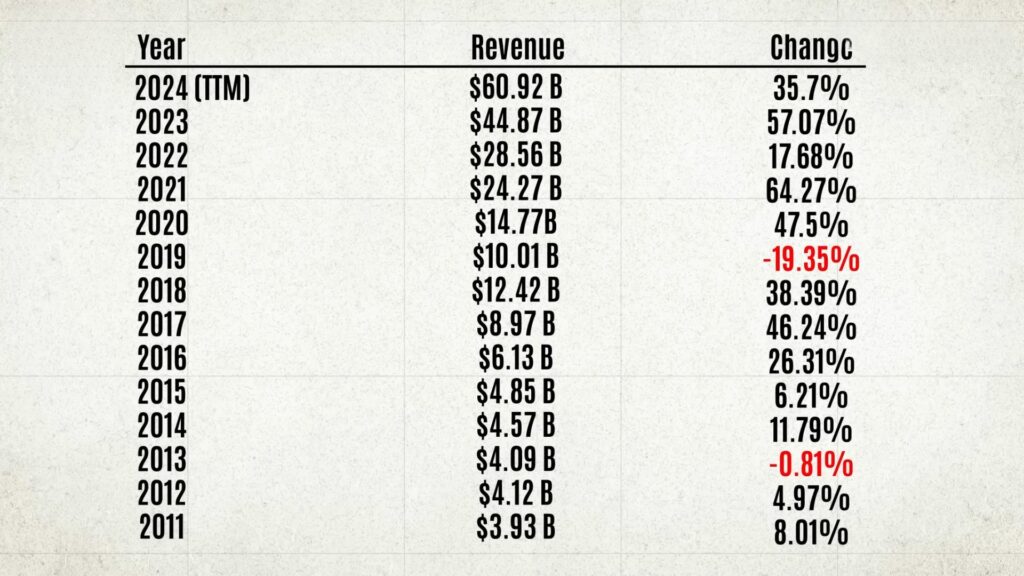

As Nvidia’s market share grew, so did its revenue. And along with revenue growth, Nvidia’s stock price and valuation also increased. In January 2015, the company’s valuation stood at approximately $10.5 billion, but eight years later, by March 2023, the company’s valuation had increased by more than 200 times to $2.13 trillion. As a result, Nvidia surpassed companies like Google, Amazon, and Meta to become the third most valuable company in the world.

Nvidia’s founder Jensen Huang had always envisioned the vast potential of parallel processing and GPUs. He dreams of a future where people won’t need to learn coding. AI will create the necessary programs and software for people, and humans will interact with AI naturally. And Nvidia will be the brain behind this vision. However, according to industry analysts, Nvidia’s rise has primarily been due to AI research, and the company’s stock is overvalued like Tesla’s. They predict that, like Tesla’s stock, Nvidia’s stock price will eventually fall. What do you think? Will Nvidia’s rise ever stop?