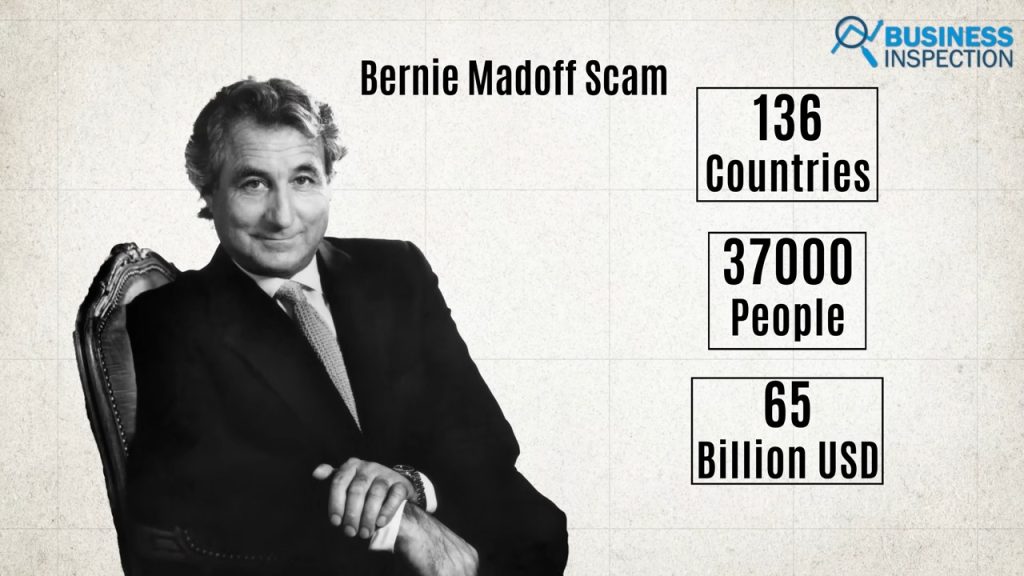

In the 19th century, several Ponzi schemes emerged worldwide. Among these scams, the person who has been running Ponzi schemes for the longest time is Bernie Madoff who defrauded about 37 thousand people in the world. Starting in the 1960s, a $65 billion Ponzi scheme operated under the guise of his brokerage firm business for the next four decades. Bernie Madoff was finally caught during the economic breakdown of 2008. An American court eventually sentenced him to 150 years in prison for 11 federal crimes. Today, we will explain exactly how Bernie Madoff managed to hide his Ponzi scheme from the whole world.

Bernie Madoff

Bernard Lawrence Madoff or Bernie Madoff was born on April 29, 1938, in Brooklyn, New York. Business-minded from a young age, Barnie started a business fixing sprinkler systems while in high school. After graduating high school in 1956, Barnie studied at the University of Alabama for one year. But, the following year he transferred from there to Hofstra University in New York and completed his graduation in Political Science in 1960. After graduation, he was admitted to Brooklyn Law School to study law, but Barnie dropped out of law school that year. In the same year, Bernie Madoff established a broker-dealer company named Bernard L. Madoff Investment Securities or BMIS in her wife Ruth Madoff’s father’s accounting firm. For the initial investment, he used $5,000 that he managed to save from his sprinkler businesses and lifeguard job. His company was registered with the SEC that year. His wife, Ruth Madoff, primarily handled the administrative and checkbook at the company.

At that time, only a handful of large companies could be listed on the American Stock Exchange. As a result, a new market was created which was called Over The Counter Market so that all the companies that could not be listed in the market could sell their stock. Such markets have no centralized trading place and do not require any kind of listing to issue trades. Bernie’s company originally provided such stock trading opportunities. The company originally connected Penny Stocks buyers with potential sellers in the then-growing over-the-counter market, which was a perfectly legal business under SEC regulations. By operating this business, Bernie Madoff continued to do good business from the start, and his company also started to grow slowly. Meanwhile, since BMIS kept Barnie updated on the money market, Barnie started running a private investment advisory business as a side business in addition to the trading business.

In the 1970s, Bernie Madoff decided to invest on Wall Street. The Bernard L. Madoff Investment Securities company actually operated as a middleman, where the company bought and stored shares of various companies in advance and sold them to customers at the right time, charging a commission of just a few cents per share. As Bernie’s business grew rapidly in this model and the company’s turnover increased, Bernie Madoff gradually became a market maker. As the business grew rapidly, Bernie hired his younger brother Peter Madoff to join the company. Both Bernie and Peter were visionaries. At that time, if one wanted to buy or sell stocks, one had to call the brokers, knowing the stock price and quantity, and manually buy and sell the stock accordingly, which took up to several weeks to finalize. Bernie thought, if this system could be more modernized and computerized, trading the stock market would become easier. As a result, in the early 1970s, Bernie and Peter teamed up to fully computerize their trading business. As a result of this computerized trading, Bernie’s company started processing a trade in just 3 days. As a result, even the big companies in the market started falling behind BMIS. In addition, their screen-based trading system was later converted to the Nasdaq Stock Market.

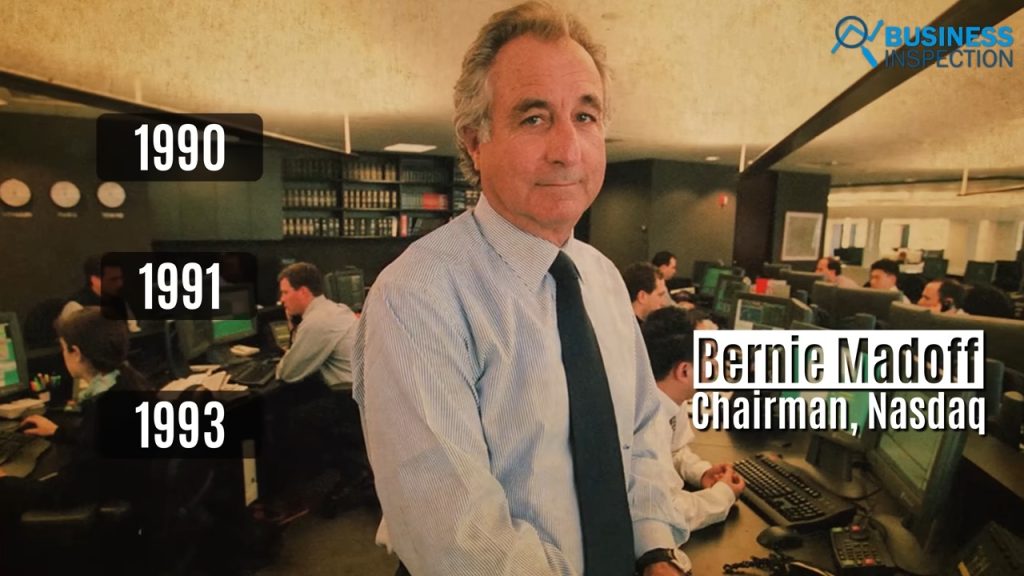

Meanwhile, in October 1987, the American stock market began to crash. During this market crash, almost every firm on Wall Street was trying to dump stocks. Even though Bernie Madoff’s trading firm was supposed to do the same in such a situation, Bernie instead ordered his employees to buy stocks. Consequently, Bernie’s firm lost millions of dollars in the market crash of ’87. But, Bernie’s decision boosted his reputation on Wall Street several fold, and he received recognition from the SEC and NYSE. Because of this one of his decisions, the SEC’s rulebook was changed to keep the stock market open even in such a crisis. This one decision of his made him from a market maker in the stock market to a reputed member of various industry and regulatory boards. His name spread so much in the stock market that he served as the chairman of NASDAQ for three years in 1990, 1991, and 1993. According to a Money.CNN source, in the early 1990s after the incident, Bernie Madoff’s Bernard L. Madoff Investment Securities alone executed 9 percent of the daily trading volume of listed stocks on the New York Stock Exchange.

The Scam

In 1960, Bernie Madoff began running another private investment advisory business alongside his trading company, Bernard L. Madoff Investment Securities. Bernie’s father-in-law, Saul Alpern, was an accountant by profession, so he referred many of his clients to Bernie’s new business. By doing this, Bernie easily got 20-25 investors. Meanwhile, if a person runs a money management business and has 20 clients, he has to register with the SEC, which Bernie never did. Bernie’s father-in-law, Saul, collected money from clients and gave it to Bernie as a fund for investment. Bernie would invest them properly, and Saul would return the money to the investors after making a profit.

Although Bernie’s side business went well, in May 1962, the stock market suddenly crashed in America. The situation was so dire that all the stocks Bernie had bought with his investors’ money were wiped out of the market. In such a situation Bernie could admit his failure and inform the investors that the stock in which their money was invested was lost. But Bernie Madoff didn’t. Instead, he borrowed $30,000 from his father-in-law Saul and returned it to the investors, without letting them know the truth. Bernie Madoff believed that he could live with lies, but he could not live with failure. Meanwhile, this lie made him a hero on Wall Street. When Bernie was able to return his investors money even in such a big stock market blackout, everyone started to accept him as a stock market genius. This increased investors’ confidence in Bernie Madoff and started to grow his trading business as well as his investment advisor business. Until now, Bernie was only managing the money of his father-in-law’s referred clients and family members. After this incident Bernie started getting more investors through various feeder funds.

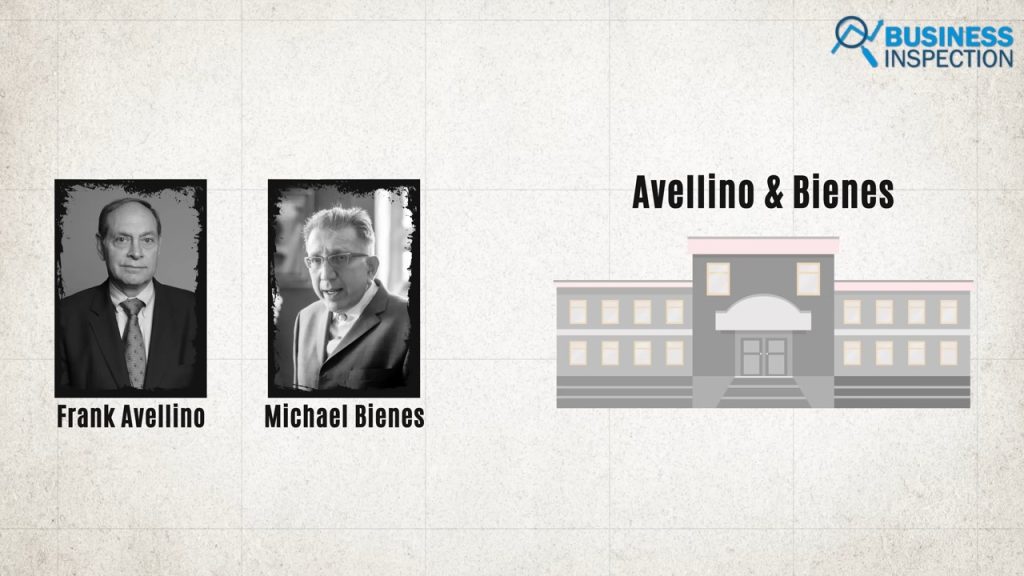

Meanwhile, Saul Alpern stepped forward to retire from his accounting firm and hired two accountants, Frank Avellino and Michael Bienes. After Saul Alpern’s retirement, the two accountants changed the firm’s name from Alpern & Heller to Avellino & Bienes. Avellino and Bienes knew Bernie’s private investment advisory business through their work at Alpern & Heller. Accordingly, the two accountants began collecting money from a variety of companies, family businesses, and corporations to individual investors, creating a fund and transferring it to Bernie. Despite initial small investments, at some point Avellino and Bienes began funneling large amounts of funds to Bernie. By doing this, Bernie’s unofficial business started to grow even faster.

In 1992, Bernie Madoff’s investment advisory business was caught by the SEC for the first time because of the two accountants’ extravagant levels of investor attraction. From the beginning, Avellino and Bienes were raising large investment funds for Bernie on a commission basis. There was no chance of getting caught as there was no document in the ledger of those fundings. But, as raising funds from various sources in a word-of-mouth system alone is a hassle, the two prepare a brochure touting 100% safe investments and extremely consistent rates of return. And if this brochure is circulated, it will come to the attention of the SEC. SEC suspects this investment company may be running a Ponzi scheme, otherwise, there is no way a company can offer 100% safe investment and a constant rate of return. Avellino and Bienes were quickly caught when the SEC’s investigation began. Both pleaded guilty and said they collected nearly $500 million from customers but kept none of the money. They said that the money collected from various investors was actually managed by Bernie Madoff.

Avellino and Bienes’ confessions set the SEC’s investigation on course. But, by then, Bernie Madoff had become one of the most reputable persons on Wall Street. As a result, even the SEC’s investigation team had to think twice about investigating him. As a result, they were so concerned about Bernie that Avellino & Bienes was asked for their financial report, which they failed to produce. On the other hand, keeping in mind the protocol, the SEC also requires Bernie to report their transactions. Bernie, with right-hand man Frank Dipascalli, who runs his advisory business, created fake trading documents from historical data and showed them to the SEC. The SEC was convinced by that document and did not conduct any further investigation against Bernie. On the other hand, the SEC shut down Avellino & Bienes’ business for failing to provide financial reports. However, Bernie returned the $500 million to investors almost immediately after the incident. But, the investors had already benefited so much from Bernie that none of them took the money back from Bernie and instead gave that money back to Bernie to manage. Bernie Madoff’s fortunes improved after this incident. Bernie’s existing investors gained more confidence after the SEC’s clearance. In addition, investors who were connected to Bernie through Avellino & Bienes began to shift their money management to Bernie.

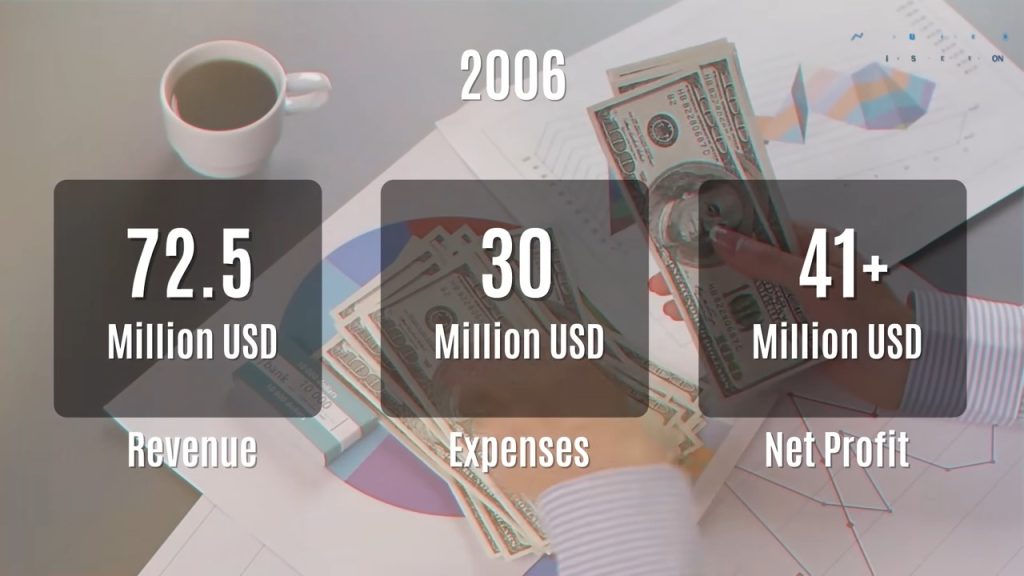

Bernie Madoff’s trading company, Bernard L. Madoff Investment Securities, had offices on the 18th and 19th floors of Manhattan’s famous Lipstick Building. The firm traded all types of securities, from stocks to bonds and other securities, both for themselves and for clients. In 2006, the company generated a total revenue of $72.5 million, of which the company had a net profit of over $41 million that year, excluding expenses of approximately $30 million. Looking at the activities of the 18th and 19th floor, this amount of profit should seem quite normal. Even the regulatory body of the brokerage business SEC and other financial institutions have given clearance to Bernie’s two-floor operations several times. A number of audits are also conducted on the firm every two years. However, no one realized that Bernie Madoff owned another floor in the Lipstick Building. No one even noticed that this business of his was actually covering that unknown floor.

Bernie Madoff’s untitled, unofficial investment advisory business operated on the 17th floor of the Lipstick Building. Bernie Madoff started running the Ponzi scheme through his business, although exact information is not available, but in an interview, he said that he ran this scheme for 20 years before being caught. In the beginning, Bernie Madoff paid investors to invest in shares of good companies and returned the returns to investors with profits. Instead, he would charge a fee instead of taking a commission. However, it is not known how much his fee actually was. But then when the investment amount started increasing, Bernie stopped taking money from investors and investing it in shares or elsewhere. All the investors that came to Bernie Madoff were not actually coming directly, but through various third party feeder funds, which were mostly run behind the Avellino & Bienes firm. Also, when a person invests and gets a constant rate of return, he informs the wealthy persons around him about it, and they also invest. In this way Bernie was constantly getting investors. Besides, his family or friends also used to bring him investors at various times on the basis of commission. Bernie Madoff had an account at JPMorgan Chase Bank where checks from investors or client money transfers were deposited directly into this account. Whenever an old client’s investment reached maturity, Bernie would pay the money from this account with the profit, and collect the new investor’s money and keep it in that account instead of investing it anywhere else.

Thus his scheme was going quite well. But trouble broke out in the 2008 global financial crisis when the entire American stock market collapsed. From the Nasdeq to the NYSE and the ASE, every company’s share price started to drop, and the share prices of various companies were completely wiped out. In such a situation, Bernie Madoff’s investors also started demanding money back from him. At that time, Bernie’s clients claimed a total of $7 billion from him, against which Bernie had only $200 to $300 million left in his account. In such a situation, Bernie decided to pay the bonus of the loyal employees working in his company from this remaining money. On December 10, 2008, when Bernie’s two sons, Mark Madoff and Andrew Madoff, asked Bernie for the full story, he confessed to the long-running Ponzi scheme. The two sons are completely fed up after hearing about this scam of the father. Bernie Madoff was arrested at the Lipstick Building on December 11, the day after Mark and Edro told the FBI the full story. The conman behind the biggest Ponzi scheme of all time, Bernie Madoff, was finally caught.

On March 12, 2009, when Bernie Madoff was convicted of 11 federal crimes, Bernie admitted to running a Ponzi scheme over the past 20 years. Based on his confession, the court sentenced Bernie Madoff to 150 years in prison and fined him 170 billion dollars for embezzling $65 (64.8 billion) billion dollars from 37,000 people in 136 countries. Two years after Bernie Madoff’s arrest, his eldest son Mark Madoff committed suicide in 2010, unable to bear the humiliation. Four years later in 2014, Bernie’s youngest son, Andrew Madoff, died of cancer. Meanwhile, Bernie Madoff died on April 14, 2021 at the age of 82 at the Federal Medical Center in North Carolina.