The Sahara India conglomerate was once one of India’s largest business empires. For over four decades, the company grew into a major employer, second only to the Indian Railways. Sahara even sponsored the Indian and Bangladesh national cricket teams for many years. However, in the mid-2000s, Sahara became embroiled in one of India’s biggest financial scams. The company was accused of swindling investors out of over $5 billion through illegal bonds and financial products. This massive scandal made headlines as one of the largest cases of corruption in the country. Although Sahara had been a prominent business for decades, the company’s reputation was tarnished after the allegations of immense fraud and deception emerged.

Subrata Roy, the founder of the Sahara India family, was born on 10 June 1948 in Araria, Bihar. After losing his father Sudhir Chandra Roy at a young age, Subrata Roy had to leave his studies during his diploma to take charge of the family as the eldest son of the family. While working with Jaya Products, Subrata Roy came to know people from poor tea sellers to rickshaw pullers, daily laborers and various types of laborers in different villages of Gorakhpur area. He observed that these people earn very little amount every day. Due to which, they do not think about the money that should be saved for the future as well. It can be seen that these poor people have to borrow money with high interest rate when any big danger or need suddenly arises.

Seeing this financial struggle, Subrata Roy planned to bring about a change in the condition of these poor people. He started explaining to them that if they can save at least 1 rupee a day, then gradually they can accumulate a large sum of money. While educating the poor people of the village about saving, Subrata Roy found a new business opportunity. In view of which, in 1978, he established a company called Sahara India in Gorakhpur. Sahara means Savior in Hindi language. And, Subrata Roy also named his company Sahara India from his plan to work as a savior for these poor left-out people.

Then, he explained to the poor working people of Gorakhpur and its surrounding areas that he would collect a small amount from them every day as a deposit and after three years return each of them double their total amount. Besides, he told them that if they keep money from him, they can use it when they need it. This idea of Subrata Roy seems very convenient to these poor people of the village. Because, the income of these poor people was so low that they had no opportunity to save money in a bank or any other financial institution.

After persuading the villagers to deposit money, Subrata Roy started going door-to-door on his scooty every day to collect whatever money he could, Rs.10, Rs.15.

It is not known where Subrata Roy used to collect daily money from the customers and invest it, but after the expiry of the period, he used to return the money to the customers along with the profit. Besides being right in word and deed, customers keep getting more and more trust in Sahara India by getting a large amount of money at once. As a result, the Sahara grew rapidly in the 1980s. Then, as it became difficult for Subrata Roy alone to collect money from so many customers, he started appointing agents in the company for this task.

To become an agent of the company, a person first had to invest some money himself, and convince other people to invest. In view of which Sahara used to pay a fixed rate of commission to these agents. And, because of such an easy process, the company was able to hire thousands of agents at once. The number of Sahara agents across India exceeds lakhs.

One of the reasons why the Sahara grew so fast was that India went through a major economic reform in the 1990s. At that time, such a large population of the country was not very prosperous and there were not so many opportunities in terms of work. Most of the young people of the country were looking for new ways of income. And the lifestyle the agents of the Sahara were maintaining was very lucrative. And as there is an opportunity to become an agent of the company with a small investment, the number of agents of the company continues to increase across India. As a result, the number of investors increased.

As the number of investors and agents continued to grow, Subrata Roy announced Sahara India as the world’s largest family, promoting the name Sahara India Pariwar in the company’s advertising, marketing and branding.

Since the 1990s, the company has started investing in new ventures and new ventures in a variety of industries. In 1992, the Sahara family started publishing a Hindi newspaper called Rashtriya Sahara. In the same decade, the company started a world-class level township project called Aamby Valley City on 10,000 acres of land in Mumbai. Sahara entered television media in 2000 with the launch of Sahara TV. Besides, in 2003 the company also started publishing weekly magazines like Sahara Samay (Hindi) and Sahara Aalmi (Urdu).

Meanwhile, Subrata Roy self-populated the board of Sahara India family with popular and respected personalities of the country. Starting from Amitabh Bachan, celebrities like Jaya Bachan, Kapil Dev, Amar Singh, Saurav Ganguly, Aishwarya Rai, retired government officials, police officers and army officers were board members of the Sahara family.

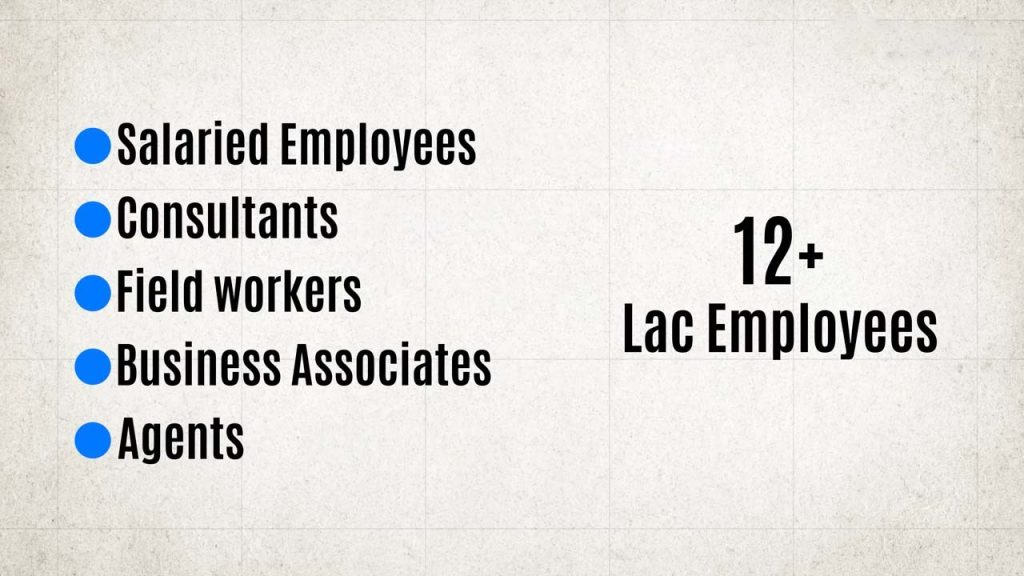

In 2004, the popular Time magazine named the Sahara family as “The second-largest employer in India“. By then, the company’s workforce, ranging from salaried employees to consultants, field workers, business associates and agents, exceeded 12 lakh.

Apart from India, the Sahara India family used that money to buy various real estates in the country and abroad, starting from its own airline service, to establishing hotels, restaurants, television channels, and international tourist resorts. In between, the Sahara India family built a town called Sahara City in UP’s Lakshmana, where Subrata Roy originally lived with his entire family.

Apart from this establishment, the Sahara India family also sponsors the jerseys and kits of the Indian National Cricket Team and Hockey Team. Besides, in the 2010 IPL season, Sahara bought an IPL team named “Pune Warriors India” from Pune for Rs 1700 crore and participated in the tournament.

In addition, in 2004 Subrata Roy arranged the weddings of 101 couples at his own expense as an act of charity, gifting each couple 5 lakh rupees to begin their new lives. Most Sahara customers were grateful to the company. Because this low-income population was able to provide higher education or marriage for their children thanks to the profits from Sahara investments. For these reasons, Subrata Roy became revered like a god by millions across the country. In fact, Subrata Roy became so beloved that people began calling him “Saharashree.” Some would even touch his feet in veneration. For some, at the time, he was also seen as the Robin Hood of India’s poor people.

In just two decades the Sahara Group created such a vast empire that it caught the attention of several prominent independent journalists in India. Their suspicion was that Sahara might be paying profits to lapsed customers using deposit money, like a Ponzi scheme, and investing customer deposits to fund expansion into so many new companies and infrastructure projects. Since Sahara was not publicly listed, there was no legal documentation of the company’s finances. So if Sahara did anything illegal there was no way to uncover it. Furthermore, when independent journalists wanted to publish or broadcast reports critical of the Sahara Group, newspapers and TV channels often declined. Because at that time, starting from Indian papers and channels, Sahara’s advertisements dominated. As a result, these media outlets did not want to lose a major source of their revenue.

Meanwhile, starting in 2000, instead of collecting deposits door-to-door through Sahara agents daily, they set up deposit offices at certain distances in different areas where depositors had to go themselves or send someone to make deposits. But since most Sahara Group depositors were day laborers and poor farmers, it was very difficult for them to deposit money during working hours. In such cases, those unable to make daily deposits would repeatedly receive letters from Sahara identifying them as defaulters. Sahara would confiscate a defaulter’s entire deposit after repeated offenses. As these incidents accumulated among depositors, the number of depositors also started to decrease over time. As a result, the inflow of deposits into Sahara declined as well.

Meanwhile, as Sahara Group’s cash flow dwindled, Subrata Roy decided to list two of the company’s key businesses on the Indian Stock Market in 2007. On 30 September 2009, a prospectus was issued to SEBI for the initial public offering (IPO) launch of Sahara Prime City, a Sahara Group company. While analyzing the prospectus, SEBI found several irregularities in the fund-raising process of Sahara India Real Estate Corporation and Sahara Housing Investment Corporation, two companies under the Sahara Group. Their suspicions were confirmed when the Professional Group for Investor Protection in December that year, and Roshan Lal of the National Housing Bank on 4 January 2010, accused the two companies of illegally raising funds by issuing Optionally Fully Convertible Debentures (OFCDs).

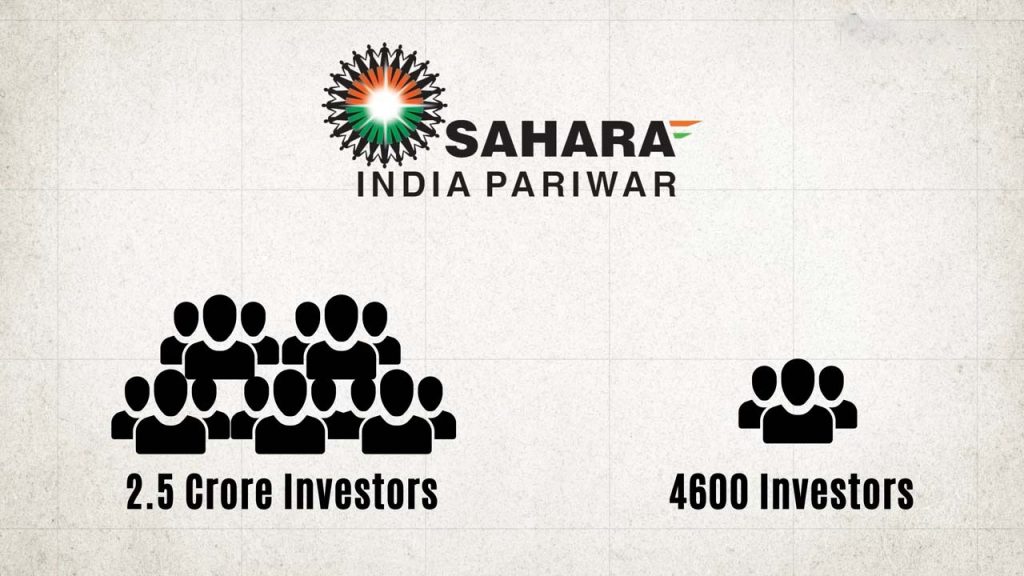

Due to this incident, SEBI initiated an investigation against the two institutions. SEBI first sought clarification on the fundraising method of the two companies through the Sahara family’s own investment banker, Enam Securities, and later directly from the Sahara India family. During this investigation, SEBI discovered that the two companies had raised approximately 24,000 crore rupees from 2 to 2.5 crore investors by issuing OFCDs. In light of this, SEBI demanded accountability from the Sahara family regarding why Sahara did not seek SEBI’s permission before raising funds.

In response, Sahara claimed that since the bond was a hybrid product, it fell under the jurisdiction of the Ministry of Corporate Affairs’ Registrar of Companies (ROC), from which it had already obtained permission, rather than SEBI. However, per Indian law, when a company issues securities to 50 or more investors, obtaining SEBI’s permission is mandatory, which Sahara failed to do. Consequently, SEBI ordered the two Sahara companies to cease fundraising through OFCDs and return the money taken from investors along with 15% interest.

Sahara first approached the Allahabad High Court and then the Supreme Court of India, but both courts ruled in favor of SEBI’s order, directing the Sahara India family to submit evidence regarding the source of their funds. When Sahara failed to provide satisfactory evidence, the Supreme Court in August 2012 ordered Sahara to return all the money to investors with 15% interest within 3 months through a joint account with SEBI, and to submit investor OFCD holder details to SEBI.

In 2013, Sahara sent 127 trucks with 31,000 boxes of investor documents to SEBI headquarters. While verifying their authenticity, SEBI found the documents did not contain correct and complete investor information, leading SEBI to suspect money laundering.

Meanwhile, when Sahara failed to refund the money within 3 months, the Supreme Court allowed Sahara to return it in 3 installments. Sahara paid 5,120 crore rupees in the first installment but did not deposit the remaining two. Rather, they claimed Sahara had already returned the rest to investors in cash. However, out of the alleged 2.5 crore investors, only 4,600 investors came forward to claim refunds despite knowing about it.

Therefore, Sahara claimed the money was returned to the rest as they had not come forward. When SEBI requested evidence to prove this claim, Sahara failed to provide any. They also failed to show the source of the funds used for the claimed repayments.

By that time, all bank accounts and other properties of the Sahara India family were frozen when SEBI and the Supreme Court started considering the Sahara case as money laundering. When SEBI again approached the Supreme Court against Sahara in 2013, the Supreme Court restricted Subrata Roy’s foreign travel starting November that year.

Later, on 20 February 2014, the Supreme Court ordered Subrata Roy to appear in court, but when he did not, the Supreme Court issued a non-bailable arrest warrant against him on 26 February. Following this, he was arrested in Lucknow on 28 February and taken into police custody. On 4 March, the court sent Subrata Roy along with other Sahara India directors to Tihar Jail to serve their sentence.

When Subrata Roy’s mother died on 6 May 2016, the court released him on parole for four weeks. After that, he has not been sent back to jail. Subrata Roy has remained active in business from outside jail and founded an electric vehicle company called Sahara EVOLS in 2019.

Meanwhile, SEBI has not yet been able to refund all investors due to a lack of proper investor information.

Leave a Comment