Gautam Adani, founder, and chairman of India’s Adani Group was the 3rd richest person in the world and South Asia’s richest person with a net worth of $127 billion in January 2023. But in a span of just two months, Adani’s net worth fell to about $49 billion at the end of March, and he was ranked 24th on Forbes’ billionaire list. On January 24, 2023, US-based investment research firm and short-seller Hindenburg Research published a report. The day after the publication of this report, the 7 listed companies of the Adani Group collectively lost Rs 55 thousand crore in market value and lost a total of Rs 12 lakh crore in one month. Meanwhile, after the publication of the report, Adani’s affinity with the ruling Modi government in the Indian Congress led to an uproar among the media and citizens of the country as the opposition parties campaigned against the government. That has also affected Adani’s Godda Power Plant electricity import deal with Bangladesh, and the Bangladesh government is sitting with the Adani Group to restructure the earlier deal.

Overview of Adani Group

Gautam Adani, the founder of the Indian conglomerate Adani Group, started his business career in 1980 by setting up his own diamond brokerage firm in Zaveri Bazaar, Mumbai. He became a self-made millionaire at the age of 20 with this business. Then he returned to Gujarat and started an export-import business. Adani’s business empire began in 1995 when it won the contract to operate Mundra Port in Gujarat. Adani Group is currently the largest multi-port operator in India. Apart from ports, Adani Group is India’s largest private power producer and coal miner. Along with India, Adani also has ports and mining businesses in Australia. Not only ports, but Adani is also India’s top private airport operator.

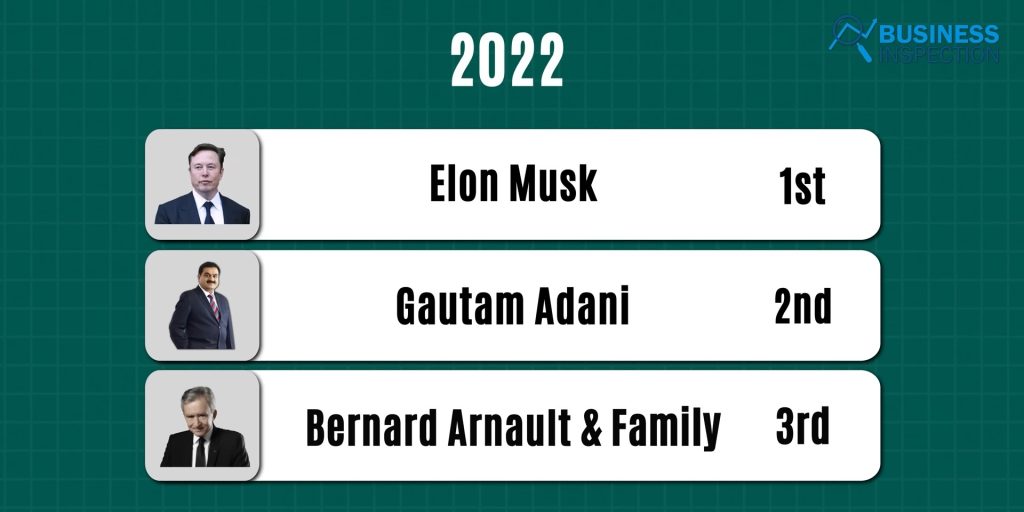

According to Forbes, in February 2022, Gautam Adani surpassed Mukesh Ambani to become the richest person in Asia and the tenth richest person in the world with a net worth of more than 90 (90.1) billion dollars. By the end of 2022, Gautam Adani’s net worth had increased to more than $150 billion, making him the top richest person in Asia and the second richest person in the world.

As of January 2023, Gautam Adani’s net worth was around $120 billion, and he was still in the 3rd position among the top billionaires. Meanwhile, on January 24, American forensic financial research company Hindenburg Research published a 106-page report titled “Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History“. The report accuses the Adani Group of everything from stock manipulation to tax evasion, accounting fraud, and more. Based on these allegations, the Adani Group released a 413-page ADANI RESPONSE report on January 29, calling each of Hindenburg’s allegations false and calling Hindenburg the “Madoffs of Manhattan”. The report even threatened to sue Hindenburg in the International Court of Justice. In response to this, Hindenburg published another report called “Our Reply To Adani: Fraud Cannot Be Obfuscated By Nationalism Or A Bloated Response That Ignores Every Key Allegation We Raised”, from which it is known that 62 of the 88 questions asked by Hindenburg in the Adani Group’s response are not answered. There was no proper response in kind and the Adani Group was also called upon to file a case.

Due to such a situation, the shares of all subsidiaries of the Adani Group collapsed. Besides, the name of Bangladesh is also involved in the incident of the Adani Group. The Bangladesh Electricity Department has a 25-year power supply agreement with Adani Power, an Adani Group concern. After the Adani Group scam came to light, on February 14, Indian National Congress Party leaders in the Indian Parliament also raised the question, “Did Narendra Modi forcefully force Bangladesh to buy electricity from Adani?” In such a situation, the Bangladesh government has also decided to reconsider the purchase of power from Adani Power.

The Adani Saga

Hindenburg Research published its report on January 24, 2023, after investigating various concerns and the activities of the Adani Group for the last two years. The report claims Adani Group’s stock market-listed companies are overvalued by 85 percent.

Not only that, out of 7 major concerns of Adani Group, 5 companies have a Current Ratio below Standard 1. The current ratio basically refers to the amount of total current assets against the total current liabilities of an organization. If a company’s current ratio is less than 1, then there is a possibility that the company will fall into a liquidity crisis or fail to make debt repayments. The condition of the 5 subsidiaries of Adani Group is similar.

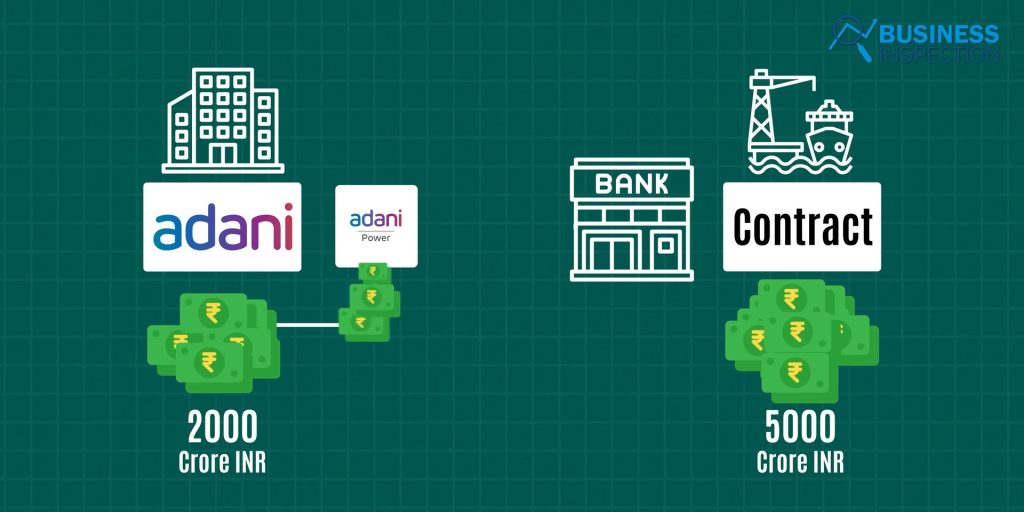

Besides, the main reason behind the listed companies under Adani Group being overvalued was to facilitate intra-group funding among Adani Group concerns. In order to fund its struggling concerns, Adani Group used to borrow from banks or financial institutions by pledging a certain amount of shares of the best-performing company within its concerns. From that loaned amount, the struggling company was lent as needed, the remaining portion was used by the borrower company for its own needs. As a result, financially struggling companies could easily get financial backups without any hassle. To simplify the concept, let’s say that Adani Enterprises has been awarded a contract to build a new port worth Rs 5000 crore. But, at present Adani Enterprises has only Rs.2000 crores with which it is not possible to build this new port. In such a scenario, Adani Power, another concern of the Adani Group, showed its profitability and growth by pledging its 12 percent stake to the bank as collateral to borrow Rs 7,000 crore, and from there lent Rs 5,000 crore to Adani Enterprises. Basically, this is how the Adani Group used to fund one company to another by borrowing among themselves.

Adani Power has pledged a maximum of 25 percent of the promoter holding shares of companies under the Adani Group. Besides, Adani Port’s pledged shares amount to more than 17 (17.31%) percent, and Adani Transmission’s pledged shares amount to about 7 (6.62%) percent.

Pledging such equity shares as collateral is quite unhealthy. Because, once the share price falls, the lending bank can call the collateral at any moment. Here, a collateral call is a type of notice, where the bank or lender institution gives notice to the receiver to provide additional financial security or possible early payment to maintain or recover the contract under which the loan was given. If the receiver does not have additional collateral available then the bank can forcefully take the step of liquidating the pledged shares.

Apart from loans, if any of the Adani Group’s concerns needed funds, other concerns in the group would buy shares in the struggling company to raise funds. For example, when Adani Transmission needed funds in 2014, Adani Group concerned Adani Enterprises and its two subsidiaries Adani Properties and Adani Tradeline funded Adani Transmission by purchasing equity. Initially, Adani Properties, a subsidiary of Adani Enterprises, acquired a 9 (9.05) percent stake in Adani Transmission. In the following year, another subsidiary of the company Adani Tradeline also bought a 9 (9.05) percent stake in Adani Transmission. Then when Adani Transmission started doing well and got listed in the market, the subsidiaries got their money back by selling the shares of the sister concerns in the company. In this case, the company that bought the property got its investment back according to the price of the stock in the stock market. For example, in the case of Adani Transmission, companies that took stakes got four times the return on investment in four years. Thus the Adani Group’s concerns have met the financial needs of other group companies by lending to each other and buying stakes and have also received good returns on investment as the 7 sister concerns of the group are listed on the market. Which helped build this vast empire of Adani.

In addition, the Hindenburg report also revealed that out of a total of 22 people in leading positions in various concerns of the Adani Group, 8 are members of the Adani family who are responsible for various important financial decisions of the group. Even, according to a former executive of the group, the Adani Group is truly a family business. Adani family members used various offshore shell companies to create higher valuations of Adani group concerns. In this regard, Adani Group has established various anonymous shell companies using its various associates in various tax haven countries of the world. The Adani family has a total of 38 offshore shell companies in Mauritius alone, which are directly controlled by Gautam Adani’s elder brother Vinod Adani and his various associates. Hindenburg Research has traced several shell companies controlled by Vinod Adani and his associates in not only Mauritius, but also in Cyprus, UAE, Singapore, and several Caribbean Islands. It is through these shell companies that stock prices are overvalued by stock manipulation through large-scale buying and selling of shares of Adani Group’s listed concerns. According to the Hindenburg report, Adani Group’s listed companies include Adani Transmission, Adani Enterprises, Adani Power, Adani Total Gas, Adani Green Energy, Adani Port, and Adani Wilmar (19.31 percent, 15.39 percent, 12.88 percent, respectively). 17.25 percent, 15.14 percent, 13.76 percent, and 1.57 percent) of Adni family members holding various offshore foreign funds, in violation of the Securities and Exchange Board of India (SEBI) rules.

According to SEBI rules, the promoters of a publicly traded company in India cannot hold more than 75 percent of the shares in that company, and the remaining 25 percent of the shares must be floated in the stock market as a public stock. Adani Group promoters hold less than a 75 percent stake in their concerns on books, but in reality, hold more than 75 percent of the total shares through their offshore shell companies. By doing this, the Adani family manipulated the share prices of the listed companies by artificially creating a share crisis in the market.

Besides, according to the Hindenburg report, most of these shell companies have no trace of any specific activities, no employee details, independent addresses or phone numbers, and even no online presence. However, evidence of billions of dollars of transactions by these shell companies with Adani’s listed and private companies in India has been found without any kind of disclosure being presented. In this case, initially, the shell companies under the control of Vinod Adani were first invested in the stocks of listed companies of the Adani group, and the money was transferred to those offshore shell companies without any disclosure by showing various investments or through mis-invoicing. This means Adani Group through its shell companies was not only doing stock manipulation but also money laundering.

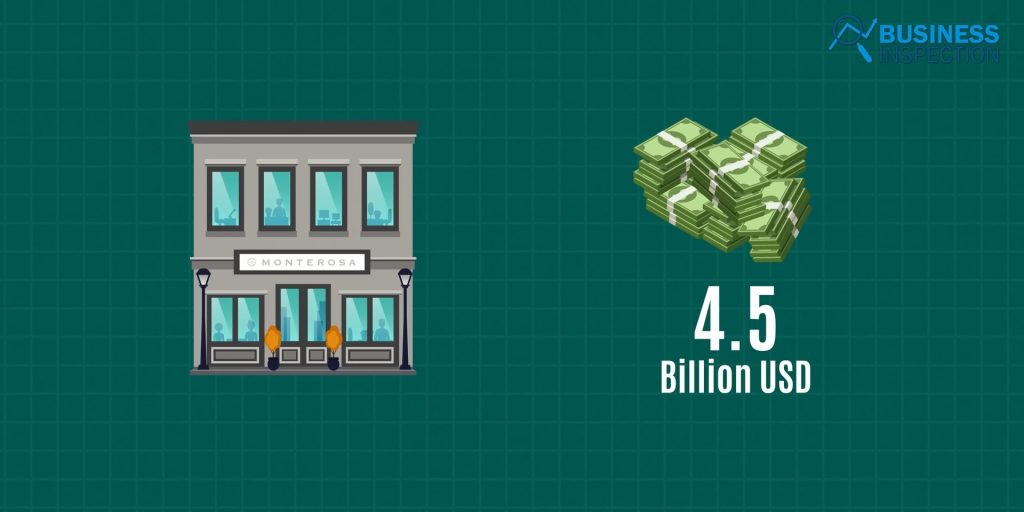

According to the report, Mauritius-based Monterosa Investment Holdings controls five funds namely APMS Investment Fund, Albula Investment Fund, Lotus Global Investment Fund, Cresta Fund, and LTS Investment Fund, which collectively hold $4.5 billion in asset holdings in various companies under the Adani Group.

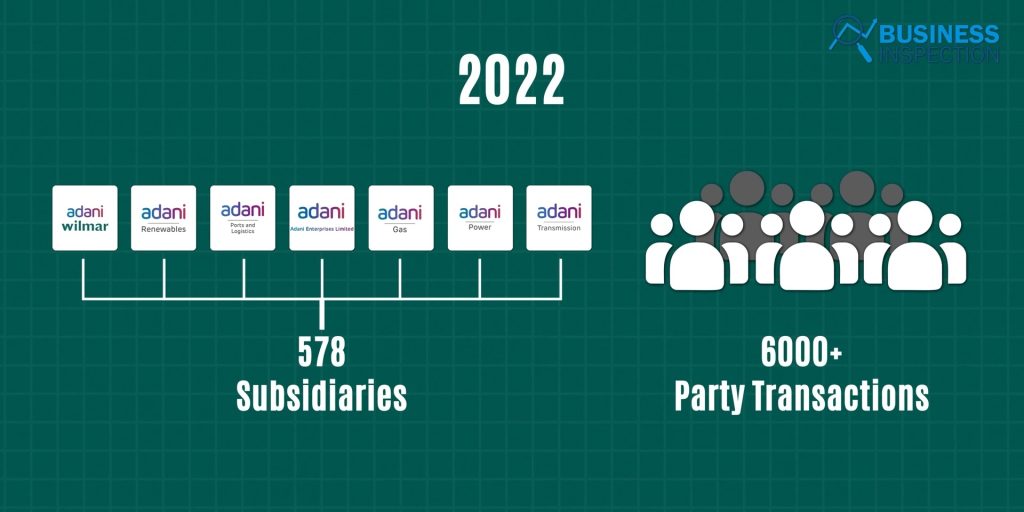

Besides, the accounting irregularities and suspicious transactions of the Adani Group were largely controlled by virtually non-existent financial entities, Hindenburg Research pointed out. Due to such irregularity, the group frequently changes the person holding the CFO post to their concerns. For example, in the last 8 years, the post of CFO has been changed 5 times in Adani Enterprises, a significant concern of Adani Group, which is a red flag regarding the accounting issues going on in Adani Group. Besides, the report also said that the responsibility of independent audit of two major concerns of Adani Group like Adani Enterprises and Adani Total Gas has been given to an audit firm named Shah Dhandharia. While most of the big groups of companies hire credible and well-known external auditor firms for their financial audits, no website was found running on the firm that Adani Group Shah Dhandharia is auditing the company with. Meanwhile, from the archive website of the firm, Shah Dhandaria had only 4 audit partners and their number of support staff was only 7. And when they started working for the Adani Group, most of them were between 23 and 24 years old. It is not true that a small audit firm cannot audit a large company. However, while Adani Group has 156 subsidiaries, several joint ventures, and affiliates, Adani Enterprises Concern alone. And the entire Adani Group, including Adani Enterprises, has a total of 578 subsidiaries of 7 concerns that conducted more than 6 (6025) thousand separate related-party transactions in 2022 alone. Hindenburg Research has questioned how such a conglomerate is completing financial audits with such a small audit firm of 11 employees aged 23-24. Along with all these major issues regarding Adani Group, Hindenburg Research made a total of 88 allegations in their report, all of which were denied by Adani Group. Hindenburg Research pointed out in a later report that most of the answers were missing from Adani Group’s answer sheet.

And the day after this report was published on January 25, 7 publicly traded companies under the Adani Group lost a total market capitalization of Rs 55 thousand crores. As the stock price of Adani Group fell, the group’s investors also started suffering huge losses. On the 27th, the group’s key investor Life Insurance Corporation of India (LIC)’s combined investment in the Adani group came down to around Rs 63 (62,621) thousand crores from over Rs 81 (81,268) thousand crores on the 24th. Besides, according to another report by Livemint, Adani Group lost Rs 12 lakh crore in market cap in the one-month period from January 24 to February 24. Not only that, even though Adani Enterprises’ FPO or Follow on Public Offering of Rs 20,000 crore was scheduled to take place on January 27, Adani Group was forced to cancel it due to the collapse in the stock market. In addition, the Adani Group also suspended the $4 (4.2) billion dollar petrochemical project in Mundra, Gujarat in March due to investors’ concerns following the release of the Hindenburg report. Currently, Gautam Adani is in the 24th position on the list of global billionaires with a net worth of around $49 billion.

General Election is currently going on in India. In such a situation, the ruling government of the country had to face a lot of fire from the opposition parties for Adani’s issues to come forward. Will Adani be able to sustain its institutions if the country’s government changes in the future? Or fall in the face of the new government and lose their position? That’s the thing to watch now.

Leave a Comment