In April 1976, Steve Jobs, Steve Wozniak, and Ronald Wynne founded a company in a garage in Los Altos, California called Apple Computer. The initial focus of the company was to design and manufacture personal computers. As a result, the company released several models of personal computers in the 80s and 90s. At the beginning of the 21st century in 2001, the company revolutionized the music listening experience by releasing the iPod. In addition, the company released the first iPhone in 2007, which ushered in the current golden age of the smartphone industry. Since its inception, Apple has brought several groundbreaking changes to the tech world that later became industry standards.

Overview

For a long time, Apple has operated as a hardware company since its inception. Until now, the majority of Apple’s revenue is generated from hardware devices such as iPhone, Mac, iPad, Wearables, Home, and Accessories products. However, Apple never dominated the hardware market. As a tech company, Apple has always positioned itself as a lifestyle brand to customers. The company doesn’t just sell devices to customers, Apple essentially offers customers the Apple Ecosystem experience, which customers get through Apple’s various devices. Due to this positioning of Apple, the price of the company’s products in the market is also slightly higher than the competitors in the same category. Due to this, it is not possible to afford Apple products to a large part of the customers. That is, in order to increase the market share, the company has to reduce the price of its products, which will again affect Apple’s brand value. On the other hand, to maintain their own revenue growth, they have to increase the price of the product every year, which will have a negative effect on the company’s sales growth.

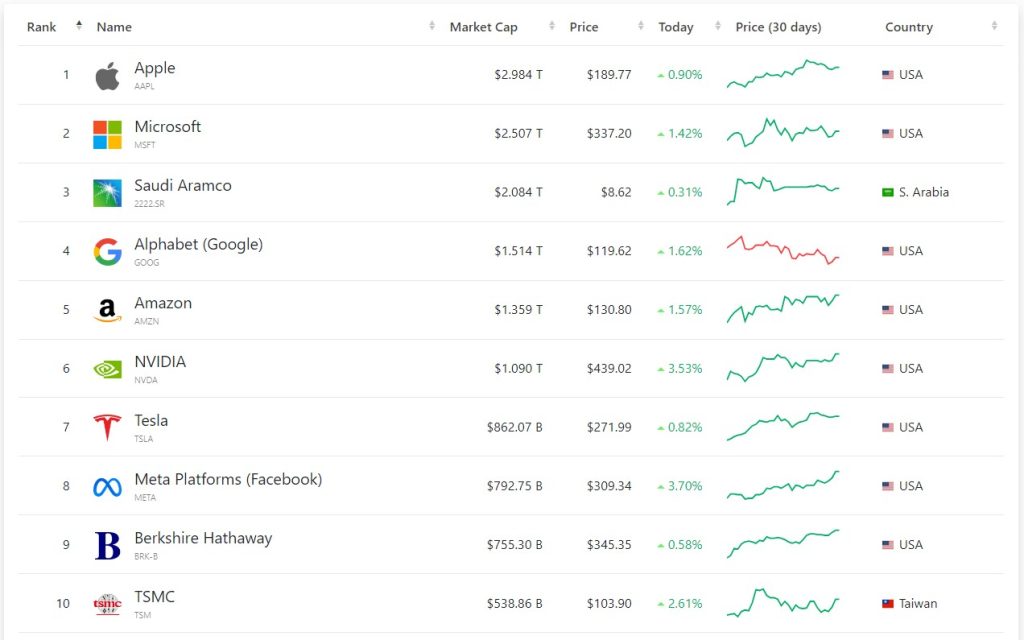

In terms of valuation, 4 out of the world’s top 10 companies are software service providers. The company brought services like iTunes in 2001, iTunes Podcast in 2005, and iBooks in 2010 for Apple device users. But there was no synergy in these services. As worldwide customers began to get used to digital subscriptions, Apple began to focus on the hardware as well as services sector in order to grow the company.

As a result, Apple Pay was launched in 2014. The following year, instead of iTunes, the subscription-based music streaming service also introduced services like Apple Music, Apple Podcast, Apple News, and Apple Fitness+. Besides, the company also introduced services like Apple TV+ and Apple Arcade in 2019. After the introduction of these services, the company’s service business continued to grow at a steady rate every year, even though it was not initially successful.

According to Apple’s annual report, Apple generated 20 percent of its revenue in 2022 from the services segment.

| Year | Services Revenue |

| 2022 | $ 78,129 Million |

| 2021 | $ 68, 425 Million |

| 2020 | $ 53, 768 Million |

Apple’s strategy was also very robust in terms of launching services. The company first launched its digital wallet Apple Pay. Having no previous experience in the financial sector and having competitors like PayPal, Google Pay, and Amazon Pay in this sector, Apple launched the service in partnership with the globally renowned investment banking company Goldman Sachs. Then one by one the existing services are relaunched and other new services are also launched. Besides, in terms of digital services, the company has prioritized finance (Apple Pay), entertainment (Apple Music, Apple Podcast, Apple TV+), information (Apple News), and health and fitness (Apple Fitness+) related services. Because all kinds of activities in the life of any human being are in these categories. In other words, in addition to the device ecosystem, Apple started working with the goal of creating an ecosystem in the digital service segment from the beginning, where Apple Pay will play a central role in availing every digital service.

Apple Pay was originally introduced as a digital wallet and contactless payment method where users could add debit and credit cards to the wallet. In 2017, the company introduced Apple Cash for Apple Pay users to facilitate P2P money transfers. Later in 2019, it also launched a physical credit card called Apple Card in partnership with Goldman Sachs. In addition, in 2019, it also launched a physical credit card called Apple Card in partnership with Goldman Sachs. Basically, the company launched this physical card so that users can make payments through the Apple Pay service even in the case of transactions with merchants who do not support the Apple Pay service. Apple gives users 2 percent cashback on every transaction using the card. In addition, users get 3 percent cashback when they use their Apple Card directly at Apple Stores, Apple’s website, the App Store, and other Apple services. On the other hand, Apple does not charge users an annual fee for the card.

In March 2023, Apple launched the BNPL or Buy Now Pay Later service called “Apple Pay Later” to provide financial support to customers for large purchases. In this service, Apple Pay users can take loans ranging from 50 to 1 thousand dollars, which can be returned in four installments without any interest or fees within the next 6 weeks. Also, in the following month, the company introduced a high-yield savings account in partnership with Goldman Sachs that is offering an APY (Annual percentage yield) of over 4 (4.15) percent. And since introducing this savings account, the question has arisen whether Apple is slowly moving towards becoming a bank.

Why Want To Become A Bank?

When Apple introduced the payment service, i.e. in 2014, the NFC (near field communication) chip-based card in the USA was far from being adopted, in fact the EMV Standard (Europay, Mastercard and Visa) could not be adopted. According to a source from EMVCo, in 2014, while about 96 percent of transactions across Western Europe, 85 percent in Canada, Latin America and the Caribbean, and about 27 percent in Asia were all transactions on the EMV standard, the amount in the USA was 1 (0.12%). Much less than a percent. Because, according to the estimates of the banks operating in the country at that time, it would have been much more expensive to transform the card transaction method into EMV technology. In such a market, when Apple Pay is introduced with the tap-to-pay feature, USA banks are also interested in joining it. Because in 2014, more than 42 percent, or 70 million of the total users of the USA smartphone market were iPhone users. That is, US banks had the opportunity to change the banking experience of at least 70 million customers through Apple Pay without any investment.

However, to integrate with Apple Pay, banks had to pay Apple 0.15 percent of each transaction amount. Basically, at that time it was economically viable for banks to share revenue with Apple instead of making large investments in NFC payment methods. The Apple Pay service gained popularity among users very quickly after its launch. Seeing the popularity of Apple Pay and the existing user base, other banks in the USA also started connecting with Apple Pay with the aim of attracting new customers and retaining their old customers. As a result, in just 1 year of launch (Oct’14-Oct’15) nearly 500 banks, large and small, in the USA signed up with Apple Pay. Apple Pay service is being introduced in different countries of the world outside the USA and the banks there are also integrating with the service. That is, Apple Pay has become a simple and comprehensive financial ecosystem for Apple customers globally.

Meanwhile, in 2019 there was considerable reluctance toward contactless payment adoption among US and worldwide customers. While around 45 percent of in-store payments were collected globally through debit and credit cards, and contactless payments through digital wallets accounted for about 26 percent. Realizing this fact, the company introduced a physical card called Apple Card so that Apple Pay users can pay online and offline everywhere from Apple’s ecosystem even where merchants do not accept in-store digital payments.

Before the launch of the Apple Card, banks used to compete among themselves in the physical card market. But, after the launch of Apple Card, the tech giant Apple also came forward as a competitor of banks in that market. Banks are also planning to launch their own digital services due to the increasing dependency of banks on Apple in the digital wallet segment and the emergence of Apple as a competitor to banks in the physical card segment. According to a source from The Wall Street Journal, major banks like Wells Fargo, JPMorgan Chase, and Bank of America are working with card payment processing companies like Visa and Mastercard to launch their own digital wallets (Paze).

A merger of banks to come up with such a competitive service is a threat to the Apple Pay service. Because, Apple is dependent on banks for user acquisition. Realizing this, in April 2023, the company introduced a high-yield savings account feature for Apple Card users under the Apple Pay service. In this, Apple Card users can open a savings account and deposit their money there. To attract users to the service, where other banks offer APY (Annual percentage yield) between 3.5 and 4.75 percent for savings accounts, Apple Card’s savings account is offering a 4.15 percent APY. Besides, the cashback received in every transaction using Apple Card will also be deposited in this savings account. That is, after introducing the Apple Pay savings account, the company’s dependence on the bank for financial services has decreased more than before.

This kind of service introduction might make it look like Apple is trying to be a bank. With a cash reserve of $165 billion, such thoughts will not be completely unreasonable. But while it is not clear whether Apple actually wants to be a bank, the company does not really need to be a bank. Although not a proper bank, Apple offers users general banking facilities such as payments, digital wallets, savings accounts, credit cards and Buy Now Pay Later services. By providing these services, when Apple is able to generate revenue by meeting the banking needs of users without being a bank, then Apple does not need to be a full-fledged bank. By offering financial services, Apple is able to gather financial activity data along with other activities of users. The company can use the data to further personalize its product and service offerings for Apple users. Besides, Apple also has its own Ad platform. Having access to users’ behavioral activity as well as financial activity allows the company to provide better targeting and more tools than other ad services. Which will ultimately play an important role in making the company a strong position in the ad business like Google, Meta, Microsoft and Amazon.

Leave a Comment