Table of Contents

The Society for Worldwide Interbank Financial Telecommunication or SWIFT is the most widely used global payment system, with around USD 5 trillion being transferred worldwide every day. Currently, SWIFT is used in more than 11,000 institutions in more than 200 countries worldwide. SWIFT is required for international transactions by any institution, including central and commercial banks of any country and financial institutions such as foreign exchanges, currency brokers, non-bank financial institutions, and asset management companies as well. But what exactly is SWIFT, and how does this system work?

Overview Of SWIFT

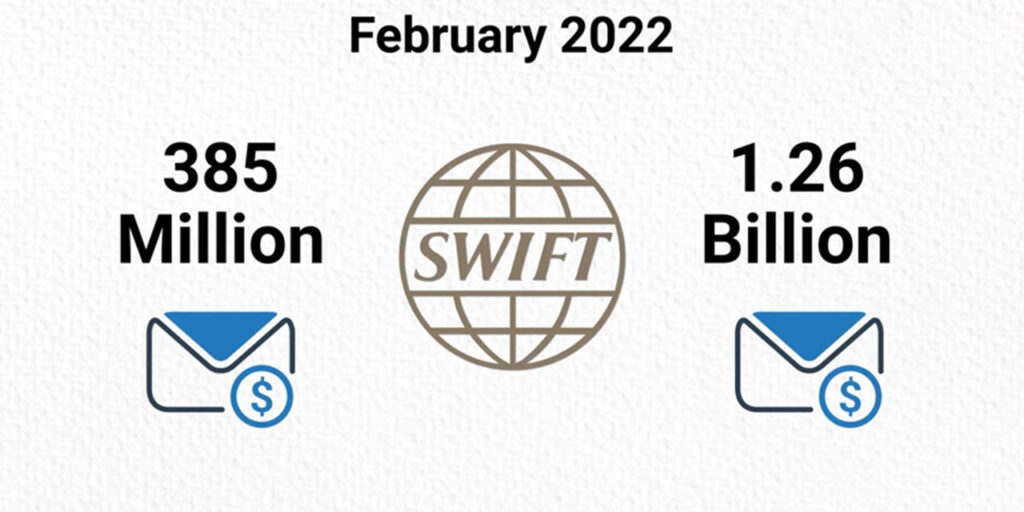

In 1973, bank officials of 239 banks from 15 countries came together in Belgium to address the global cross-border payments issue. As a result, they established the Society for Worldwide Interbank Financial Telecommunication or SWIFT in Belgium. Since 1977, SWIFT has been operating in full swing, replacing Telex technology. By that time, 517 institutes from 22 countries worldwide were connected to the SWIFT network. At the beginning of the journey, the system quickly became a reliable and trusted global partner of many financial institutions worldwide. According to SWIFT’s website, the total number of SWIFT messages in the first two months, including 385 million financial messages in February 2022 alone, is 1.26 billion.

What Is SWIFT?

SWIFT, or Society for Worldwide Interbank Financial Telecommunication, is a global messaging system used primarily for financial transactions. In the case of international financial transactions, the SWIFT network is the network through which the messaging takes place between the bank or any other type of financial institution related to the transaction.

SWIFT has been able to gain wide popularity worldwide from the very beginning of its journey due to its fast and secure money transfer facility. According to a report by medicines, the number of per-day transactions through SWIFT increased from 32 million in 2015 to 42 million in 2021.

How Does SWIFT Works?

Banks and financial institutes use the SWIFT payment system to make money transactions more secure and reliable. However, cross-border payments aren’t made directly through SWIFT. Instead, the SWIFT network has standardized IBAN or international bank account numbers and BIC or bank identifier codes. Among these two, SWIFT itself owns the BIC format and uses it to identify Banks and complete instant payments.

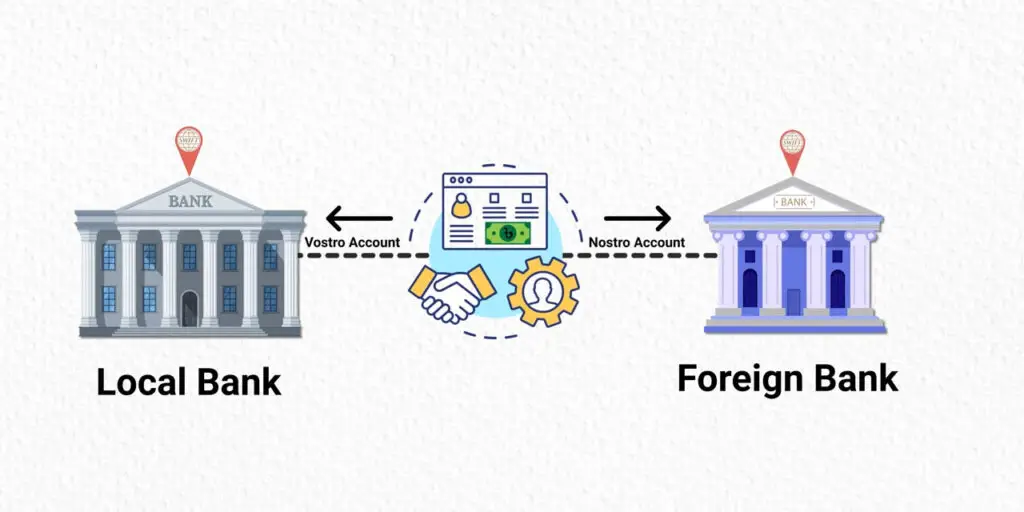

Every bank connected to the SWIFT network is assigned a unique code of 8 or 11 characters called SWIFT Code. Using this code, a bank generates a payment order for a transaction with another bank connected to the SWIFT network and sends the message through the network. Once the message is received, if the two banks concerned have Nostro and Vostro accounts, the transaction is completed as per the payment order.

Nostro and Vostro accounts are a means of settling foreign exchange between local and foreign banks. When a local bank opens an account with a foreign bank in that country’s currency, it is a Nostro account for the local bank and a Vostro account for the foreign bank.

On the other hand, if the foreign bank also opens an account in that local bank in that country’s currency, then the account of the foreign bank in the local bank is the Nostro account of the foreign bank, and the Vostro account is for the local bank.

Such accounts are usually opened for quick payment clearance among the customers of the respective banks. However, suppose there is no Nostro-Vostro account between the two banks involved in the transaction. In that case, the transaction is completed with the help of a third-party intermediary bank in the case of payment orders coming through the SWIFT network.

For example: If a customer of Bank of America requests a transaction from the USA to send money to another customer of Zurich Cantonal Bank in Switzerland, he has to visit his local branch and submit the account number, branch name, and SWIFT Code of the Zurich Cantonal Bank. As soon as the request is received, Bank of America will analyze the request from the bank’s system and send a SWIFT message to the Zurich Cantonal Bank of Switzerland.

Zurich Cantonal Bank of Switzerland will verify all the details after receiving the SWIFT message sent by the Bank of America. Once the verification is complete and there is a Nostro-Vostro account between the Bank of America and Zurich Cantonal Bank, the bank will credit the money to the customer’s account in Switzerland.

On the other hand, suppose there is no Nostro-Vostro account between the two banks; in that case, the transaction will be completed through another bank in Switzerland with which the Bank of America has a Nostro-Vostro account or through some other intermediary.

If the two banks concerned are not connected through the Nostro-Vostro account or any SWIFT payment networks, then any other intermediaries connected to the SWIFT payment network and the concerned banks will complete the transaction on their behalf. This is possible because most banks in the world follow the IBAN or International Bank Account Number standard.

Leave a Comment