Table of Contents

Globally among the card network providers, Visa, Mastercard, and Amex are the most famous names. But the number of cards issued by Visa and Mastercard worldwide is 3.7 billion and 2.32 billion, respectively, while the number of cards issued by Amex is only 121.7 million. As a result, Amex is lagging in terms of transaction amounts compared to Visa and Mastercard. But Amex is still ahead in revenue and assets compared to Visa and Mastercard.

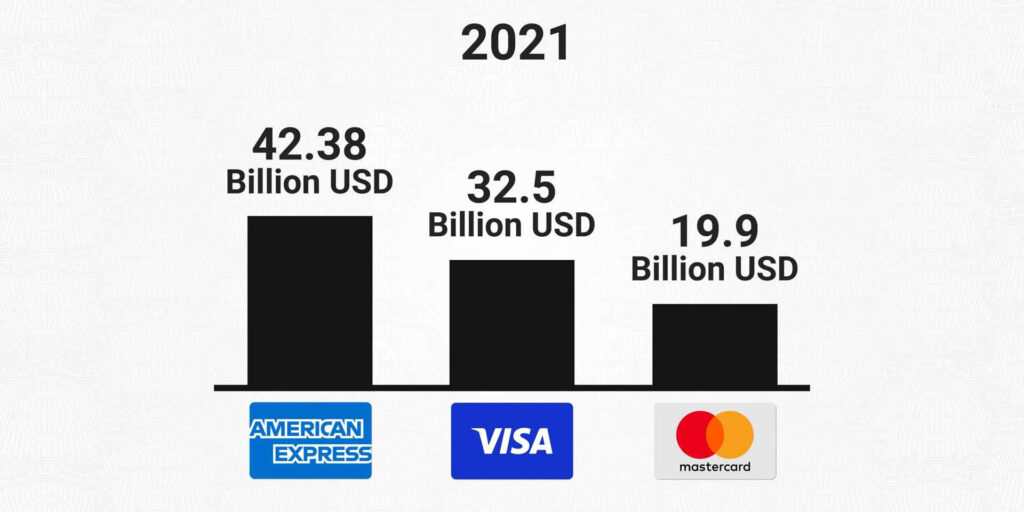

For example, in 2021, Amex had revenue of $42.38 billion, whereas Visa and master cards revenues were $32.5 billion and $19.9 billion. But how is Amex so successful despite lagging behind Visa and Mastercard in terms of cards issued?

Overview of AMEX

Visa, Mastercard, or American Express are well-known names to debit or credit card users. This is because these companies are the network providers of operating cards worldwide. However, American Express is slightly different from its competitors Visa and Mastercard. The specialty of Amex is that it is at the same time a network provider and a card issuer.

It is a global financial service-providing company that mainly provides credit card, debit card, charge card, and prepaid card issues, and network infrastructure for financial transactions. While Visa and Mastercard services are available in more than 200 countries and territories worldwide, American Express provides its services in only 98 countries and territories around the world. As a result, Mastercard has issued 19 times more cards and Visa 30 times more cards than Amex in the world number of cards issued.

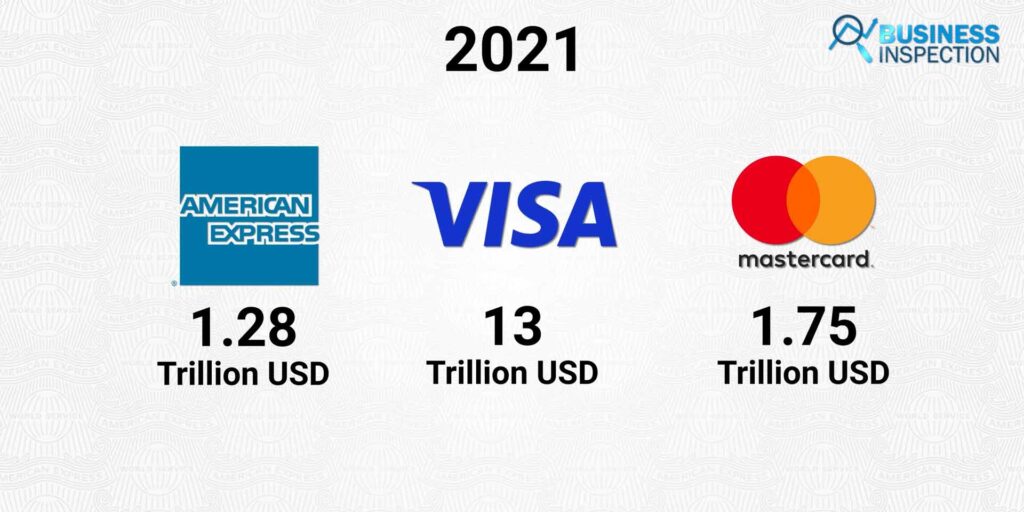

As a result, Visa and Mastercard are far ahead of Amex in worldwide transactions. In 2021, Amex’s total transaction amount was $1.28 trillion. In contrast, Visa and Mastercard’s transaction amounts were $13 trillion and $1.75 trillion, respectively. As a result, Amex’s revenue in 2021 is more than that of Mastercard. Amex has even generated more revenue than Visa. Amex has always been ahead of Visa and Mastercard in terms of revenue.

Why So Successful?

Business Model

American Express has a different business model from its competitors. According to Oxfam, only 1 percent of the world’s wealthiest people own 99 percent of the world’s wealth. Amex’s business model has been aligned considering this; the company usually targets the wealthiest people in the world. However, Amex credit card users worldwide are considered the elite class.

Globally, Amex mainly targets users with high spending rates and excellent credit ratings, such as businessmen or higher executives of different companies. Visa and Mastercard’s main competitors generate revenue by charging interest on the user’s outstanding due balance from the credit card issued. According to Yahoo Finance, 55% of USA users carry their credit cards due to the payable balance from one month to the next, a lucrative business for card companies to earn interest money.

In this context, the target of both companies is to onboard new users. But most of Amex’s core revenue comes from merchants through the processing fee for each transaction and the card’s annual fee. While Visa and Mastercard worldwide charge between 1.34 percent and 2.74 percent of the transaction amount, Amex charges between 1.68 percent and 3.55 percent, which the merchants have to pay.

Although Amex charges more from Merchants, since most Amex users are in the Higher Spender category, merchants also have to accept Amex Cards. In 2020, payments from 343 million Visa credit cards and 249 million Mastercard credit cards in the USA alone were $1.97 trillion and $837 billion, respectively. In the same year, only 53.8 million American Express credit card payments amounted to $693 billion in the United States.

In 2020, each Visa and Mastercard credit card in the United States generated an average of $5,743 and $3,361, respectively. While the Amex credit card generates an average of $12,881 in payment receipts in the same year. Amex’s spend-centric business model is one of the main reasons for its success of Amex.

Exclusivity

From the beginning of the journey, American Express has created an exclusive image of its card. The first Amex card, launched in 1958, had an annual fee of $6, which was $1 more than the then market-dominant “Diners Club” card, which has played a significant role in Amex’s exclusive image creation. The following year, to hold on to their exclusive image, Amex introduced plastic cards instead of paper cards for the first time in the market.

In addition, Amex has also introduced higher tier cards like Gold, Platinum, and Centurion cards one by one to maintain their exclusive image. The company’s Platinum and Centurion cards are basically ‘invite only’ cards offered only to high-spenders with excellent credit histories.

This kind of exclusivity has made Amex even more substantial in its brand image. As a result, Amex cards are lucrative to business people and high-spending customers. For such customers, holding Amex Platinum or Centurion cards in many cases is as prestigious as holding a limited edition car.

Superior Customer Service

The image that Amex has created around the brand, and because of Amex’s user base, the company has to pay close attention to customer service. Besides providing financial services to the users, Amex always tries to go the extra mile to solve any user problem. Since the number of Amex users is low, the company can quickly provide superior customer service to the customers compared to the competitors. In addition to training and motivating employees for customer service improvement, the company ensures its service quality by analyzing customer feedback and confidential data.

Exclusive Membership Privileges

Like other credit cards companies, such as Visa or Mastercard, Amex also has the same membership benefits. In addition, Amex offers some special membership privileges on any product purchase, such as extended warranty, purchase protection, return protection, and interruption insurance, which are available to almost all types of cardholders of the company.

However, Amex’s Platinum Card’s ‘Concierge service’ has taken the company’s customer service to a more advanced level. Although the annual fee of Amex cards is slightly higher than other Same Tier cards available in the market, the kind of exclusive membership privileges that the company offers to the users is much more valuable than the card’s annual fee. This helps Amex increase customer loyalty, and as a result, the company has become one of the most successful companies in the world.

Leave a Comment