Table of Contents

The first thing that comes to mind when you think about Switzerland is its natural beauty, high mountains, skiing resorts, chocolate, and Swiss Cheese along with Swiss banks. Due to the Swiss Banking system’s secrecy and privacy, the world’s top politicians, business people, moneylenders, drug lords, and criminals keep their billions of dollars in the Swiss banks.

Until 2021 the total amount of deposit money at Swiss banks was more than 2 trillion Swiss Franc (2.25 trillion CHF), whereas foreign clients held 1.5 trillion Swiss Francs. In 2021, Swiss Banks Bangladeshi clients’ money totaled 871.1 million Swiss Franc or BDT 8,265 core, which was about BDT 5,333 core in 2020. Due to the highest level of security and privacy provided by Swiss banks, people love to deposit both legal and illegal money in those banks.

What Is The Swiss Bank?

The Swiss bank does not identify any specific bank, rather it is a collection of more than 240 banks in Switzerland that are considered Swiss banks. Switzerland’s banking system was established around the 16th century. In 1713, the “Grand Council of Geneva” decided not to disclose their financial information to their upper-class citizens. Swiss banks started giving them this facility when kings and queens, lords, and ladies along with top business personalities were looking for a safe place to store their money, gold, and other precious jewels.

Later at the beginning of the 18th century, several bankers from France, which was closely associated country of the Grand Council of Geneva, started living in Switzerland. As Switzerland and Germany are neighboring countries, in 1865, a Swiss credit bank was established in Switzerland, where half of the total funding capital was financed from Germany. In 1912, the first banking association in Switzerland, the Swiss bankers association, or SBA, was founded.

Privateness, political stability, and economic consensus are the pillars of the Swiss banking system. However, during the great depression in the 1930s, two Swiss bankers leaked their client’s bank account information. As a result, under French and German pressure in 1934, the Swiss Banking Act was enacted in Switzerland to prevent such things from happening again.

However, today, to supervise all types of banking activities in Switzerland, three organizations: the Federal Office of Private Insurance (FOPI), the Swiss Federal Banking Commission (SFBC), and the Anti-Money Laundering Control Authority were merged, and the Financial Market Supervisory Authority or FINMA was formed. Apart from the legalization of financial markets and operating the market’s general function, FINMA’s primary objective is to protect creditors, investors, and insurance holders.

Swiss Bank’s Secrecy & Privacy

According to article 47 of the Swiss banking act, without the client’s consent, no Swiss bank or its officials can disclose any banking information of their client to any country’s government or tax authorities. If any bankers violate this rule, he/she will be imprisoned for five years. Furthermore, it is also mentioned in the article that, if any criminal activities are confirmed against a client and his/her direct involvement in the crime can be proven, the client’s banking information will be eligible for sharing.

However, in 2014, a contract was signed under the Organization for Economic Co-operation and Development or OECD by a total of 50 countries along with Switzerland, where under the terms, countries can share the financial information of their respective taxpayers with the government or tax authorities. Even after that, from the very beginning to now, Swiss banks maintain the tradition of keeping account holders’ information totally private and secure.

Because of its strict privacy maintenance procedure, Swiss banks have become a go-to place for many tax frauds, money launderers, and wealthy people worldwide to keep their assets as they don’t want to reveal their amount of assets and their source. In the last 100 years, many tried to sabotage the secrecy of the Swiss banks. But none of them were successful which is evident from the popularity of Swiss banks.

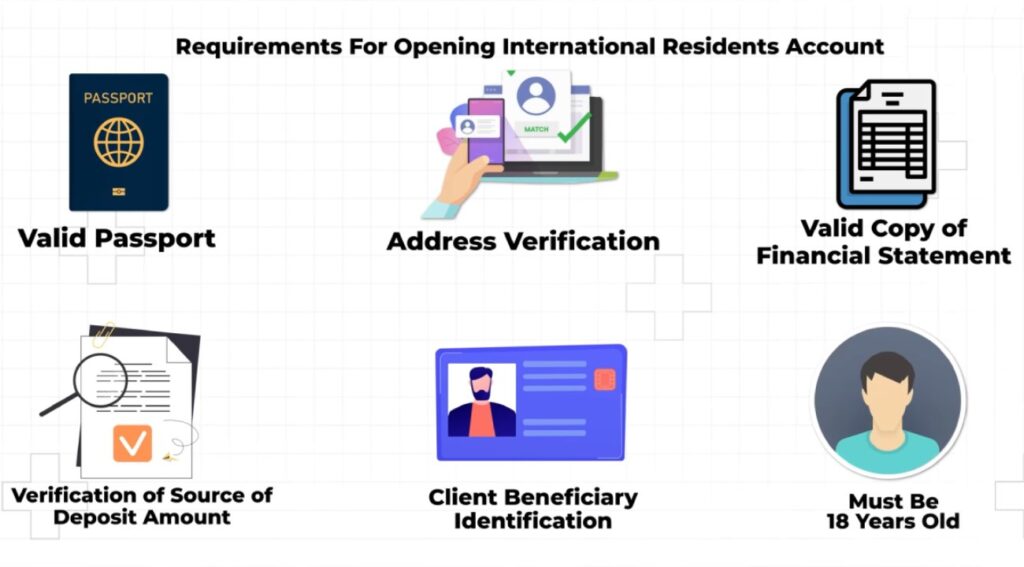

The rules for opening an account in Swiss banks are the same as opening an account in any other bank. However, there are a few documents that must be submitted for opening an international resident account like passport, address verification, deposit amount source, and client beneficiary identification, etc. However, to open an account in a Swiss bank, the client must be over 18 years old and physically present at the bank. Before opening an account, the bank authority verifies these documents, and if any record or financial transaction turns out to be illegal, then the bank authority cancels the application.

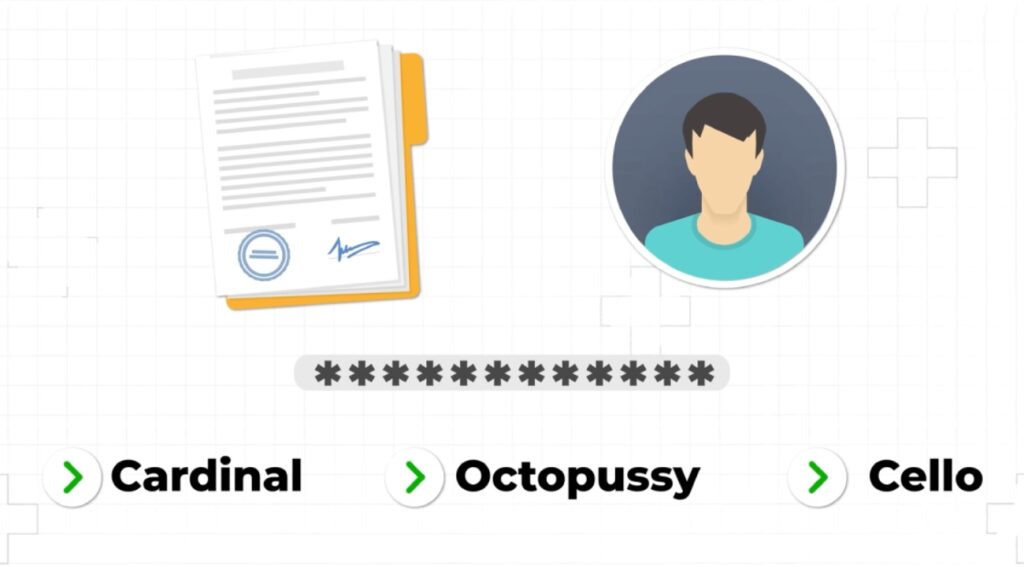

Mostly, the applications to open accounts for politicians, drug lords, or wealthy individuals to deposit their ill-gotten gains have the biggest cancellation rate. But still, these individuals use their power to create shell corporations and entities, forge transaction histories through them, open bank accounts in Switzerland against illegal funds and assets, and keep their money there for years. Several banks in Switzerland provide numbered accounts to their account holders.

In the case of such statements, the real identity of the account holder is kept secret by allocating a multi-digit number and providing a code name like Cardinal, Octopussy, and Cello as a supplement to that number which is restricted only to the client and selected banking officials. Swiss bank account holders don’t use Swiss bank checks, debit, or credit cards for regular transactions because they fear losing their privacy.

Moreover, to maintain the secrecy and security of account holders’ deposited assets, Swiss Bank vaults and bunkers are kept at various secret locations. According to Swiss Defense Department estimates, 6 out of 10 military bunkers were available for sale in the 1980s, which were bought by some Swiss bank back then. Also, several Swiss bank vaults are made by cutting mountains under the Swiss Alps.

According to Bloomberg, the main chamber of the vault has to be passed through highly skilled security guards and two levels of defense gates. There, the 3.5-tonne metal vault door can be opened only after an authorized bank official inputs a secret code on the security screen of the vault door and completes an iris scan and facial recognition. Because of this high-end security, wealthy individuals and business people from different countries feel confident about keeping their money and other valuables in Swiss banks.

Besides protecting client privacy, Swiss banks provide investment-related advice and wealth management services to their depositors.

In addition, Swiss banks also provide consultation services to general customers on various issues, like current and savings accounts, mortgages, loans, pensions, insurance management, and digital banking. However, the amount of return on investment against depositing money in Swiss banks is much lower than in other countries. According to the central bank in September 2022, the policy rate of Switzerland is -0.25 percent. However, Switzerland’s economy is relatively stable and robust. Even in this ongoing global inflation, the country’s economy and currency stand firm where the per dollar is exchanging at 0.95 Swiss Franc. That means the Swiss Franc is stronger than the US Dollar.

According to Bloomberg, Switzerland’s inflation rate hit a four-decade high of 3.4 percent because of the Russia and Ukraine war in 2022. In comparison, the USA’s inflation rate over the same period exceeded 9 percent. However, according to the Swiss central bank’s June forecast, the country’s inflation rate will fall to 1.9 percent in 2023 and 1.6 percent in 2024.

Therefore, Switzerland’s economy is in a very stable position despite various adverse economic conditions. Therefore, there is a low possibility of a liquidity crisis in the country. A strong economy also ensures that money does not decline in value much, even if it is deposited in a bank.

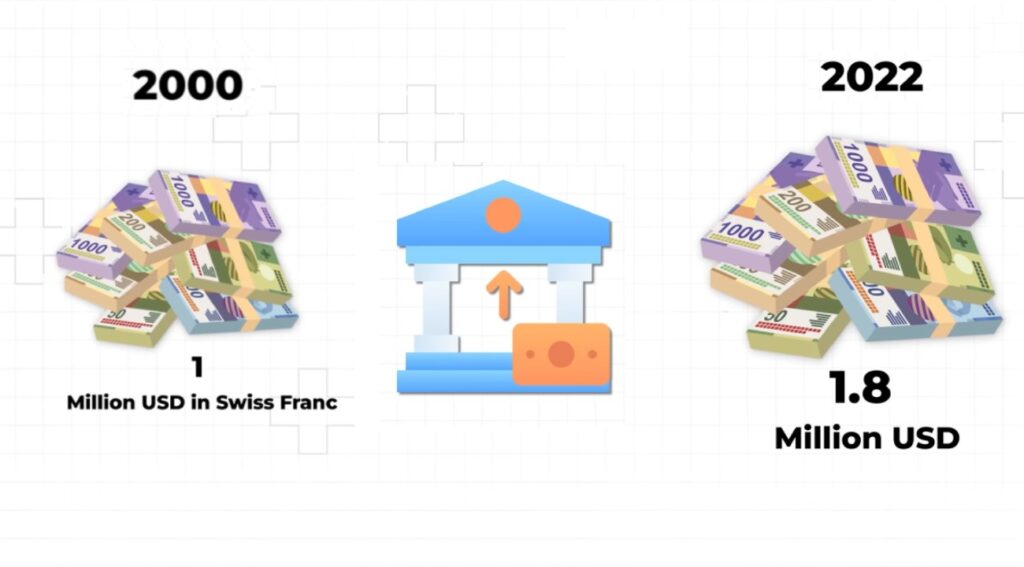

In fact, in 2000, if someone had deposited $1 million in Swiss francs in a Swiss bank, the value of that money would have increased to about $1.8 million dollars today. Because of such economic stability, privacy, and security, the world’s rich, wealthy, and unscrupulous feel comfortable storing money and assets in Swiss banks.

Leave a Comment